Helping Us Deliver the Highest Level of Care

Good Shepherd Hospice Foundation depends on the generosity and kindness of donors like you to support our mission and daily operations provided by the agency. Please consider the opportunities for giving to Good Shepherd Hospice Foundation and help us fulfill our vision for care for all our patients across Long Island.

How to Donate

Good Shepherd Hospice Foundation is a not-for-profit 501(c)3 tax-exempt institution. All gifts are tax-deductible. We live in challenging times, but your support will make a difference, no matter how large or small.

By check (make checks payable to Good Shepherd Hospice Foundation):

Good Shepherd Hospice Foundation/Development Department

110 Bi-County Blvd, Suite 114

Farmingdale, NY 11735

Call 631-465-6350 and pay by credit card or request a donation envelope to be sent to you.

EIN Number: 26-3169427

Memorial and Tribute Donations

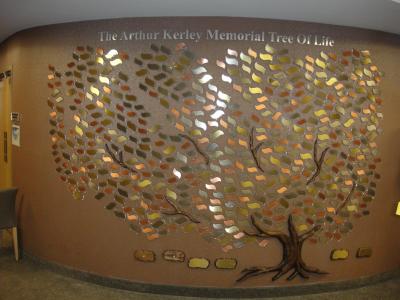

Displayed in the serene setting of the Good Shepherd Hospice Centers in Port Jefferson and Rockville Centre, NY, the Arthur Kerley Memorial Tree of Life and the Grant Thornton, LLP Donor Wall showcase elegant memorial wall mountings that pay tribute to the memory of your loved ones.

You can also make a donation to the Good Shepherd Hospice Memorial Garden by purchasing a memorial brick.

Call our Development Department at 631-465-6350 for more information.

Located at the Good Shepherd Hospice Center in Port Jefferson, NY, the Arthur Kerley Memorial Tree of Life has been a dedicated tradition since our opening in 2008 for families and friends to honor loved ones who have died. Memorial donations for the Tree of Life are accepted at the following levels:

- Small Copper Leaf—$500 minimum donation

- Small Aluminum Leaf—$1,000 minimum donation

- Large Aluminum Leaf—$1,500 minimum donation

- Large Brass Leaf—$2,000 minimum donation

- Stone at Base of Tree—$5,000 minimum donation

In Rockville Centre, NY, the Grant Thornton, LLP Donor Wall is available for families and friends to honor their loved ones. Memorial donations for this donor wall are accepted at the following levels:

- Small Blue Tile—$500 minimum donation

- Medium Tan Tile—$1,000 minimum donation

- Large Blue Tile—$2,500 minimum donation

- Large Grey Tile—$5,000 minimum donation

Located at the Good Shepherd Hospice Center in Port Jefferson, the Good Shepherd Hospice Center Memorial Garden is available for families and friends to honor their loved ones in our outdoor gathering space featuring a waterfall and beautiful greenery. Memorial donations for the Good Shepherd Hospice Memorial Garden can be made by purchasing a brick for $250.

Planned Giving

A planned gift is a donation arranged today and allocated at a future date. Making a planned gift is a wonderful way to show your support and appreciation for Good Shepherd Hospice Foundation and its mission while accommodating your own personal, financial, estate-planning and philanthropic goals.

With smart planning, you may actually increase the size of your estate and/or reduce the tax burden on your heirs. Just as important, you will know that you have made a meaningful contribution to ensure the future of Good Shepherd Hospice Foundation.

Call 631-465-6350 for more information.

A gift through your will or living trust costs you nothing now but provides support to Good Shepherd Hospice Foundation after your lifetime. You may secure a charitable estate-tax deduction for the value of your gift.

How it works:

- You include a gift in your will, or living trust, to provide support to us after your lifetime.

- Make your bequest unrestricted or direct it to a specific purpose.

- Your bequest can be general (cash or a percentage), residuary (provide for your heirs first, then the balance remaining is passed on to Good Shepherd Hospice Foundation), or a contingent bequest given only under the circumstances you describe.

Benefits:

- Your assets remain in your control during your lifetime.

- You can modify your gift to address changing circumstances.

- You can direct your gift to a particular purpose (be sure to check with us to make sure your gift can be used as intended).

- Secure a charitable estate-tax deduction for the value of your gift, which reduces the tax burden of your estate.

- Knowing your generosity will support our mission for years to come.

How it works:

- You transfer appreciated stocks, bonds or mutual fund shares you have owned for more than one year to Good Shepherd Hospice Foundation.

- Qualify to receive an income tax deduction for the full fair-market value of the stock upon being sold.

Benefits:

- You receive an immediate income tax deduction for the full fair-market value of the securities on the date of the transfer (even if you originally paid much less for them).

- Avoid long-term capital-gain taxes on any appreciation in the value of the stock.

- Giving appreciated stock can be more beneficial than giving cash. The “cost” of your gift is often less than the deduction you gain by making it.

Long-Term Retirement Gifts

- You name or designate Good Shepherd Hospice Foundation as a beneficiary of your IRA, 401(k) or other qualified retirement plan.

- Your plan administrator transfers funds as a beneficiary upon death or as an immediate IRA rollover gift.

- Tell Good Shepherd Hospice Foundation about your beneficiary designation gift. Your plan administrator is not obligated to notify us. If you don’t tell us, then we may not know.

Immediate IRA Rollover Gifts

- You must be age 70½ or older at the time of the gift.

- Transfers must be made directly from your traditional or Roth IRA by your IRA administrator to Good Shepherd Hospice Foundation.

- Annual maximum donation is $100,000 per individual. (Two spouses may each give $100,000 per year.)

- Counts toward your required minimum distribution for the year you make the gift.

Benefits:

- No federal estate tax on the gifted funds, and, as a non-profit organization, we can use 100 percent of your gift.

- Continue to take regular lifetime withdrawals.

- Maintain flexibility to change beneficiaries if your family’s needs change during your lifetime.

- Your heirs avoid the potential double taxation on the assets left in your retirement account.

How it works:

- You transfer all or part of the proceeds of your insurance policy to Good Shepherd Hospice Foundation.

- Designate Good Shepherd Hospice Foundation as an irrevocable beneficiary to receive an income tax deduction.

- Good Shepherd Hospice Foundation may surrender the policy for its cash value.

- Name Good Shepherd Hospice Foundation as a beneficiary of your policy upon death.

Benefits:

- Make a gift using an asset that you no longer need for family protection.

- Receive an income tax deduction equal to the cash surrender value of the policy.

- If premiums remain to be paid, you can receive income tax deductions for contributions to Good Shepherd Hospice Foundation to pay these premiums.

- You can make a substantial gift on the installment plan.

Special Events

Good Shepherd Hospice holds events throughout the year to help support the Good Shepherd Hospice Foundation.

The 5th Annual Good Shepherd Hospice Foundation Brunch will be held on Sunday, April 27, 2025, at the Crest Hollow Country Club in Woodbury, NY.

We are so pleased to honor Stephen McLoughlin, member of the Board of Directors of Catholic Health Services of Long Island, recipient of the 2025 Good Shepherd Hospice Community Award “In Memory of Kathleen Fabio.”

Please join us in celebrating Stephen for his inspiring commitment to our community while also supporting Good Shepherd Hospice. In addition to the award ceremony, there will be brunch cuisine and a high-end raffle table.

For more information, call 631-465-6350 or email GSHospice.Events@chsli.org.